Will Bitcoin Price Change After The New U.S. Crypto Reserve?

The proposed U.S. Strategic Bitcoin Reserve - Crypto Reserve - has been hotly debated in crypto circles.

Bitcoin is trading around $90,000 or so in April 2025, and the possible effects of this reserve have generated both optimism and caution.

This piece takes a look at the crypto reserve, historical comparisons to gold reserves, market sentiment, effects of regulation, as well as expert predictions, finishing with bullish and bearish scenarios for the price of Bitcoin.

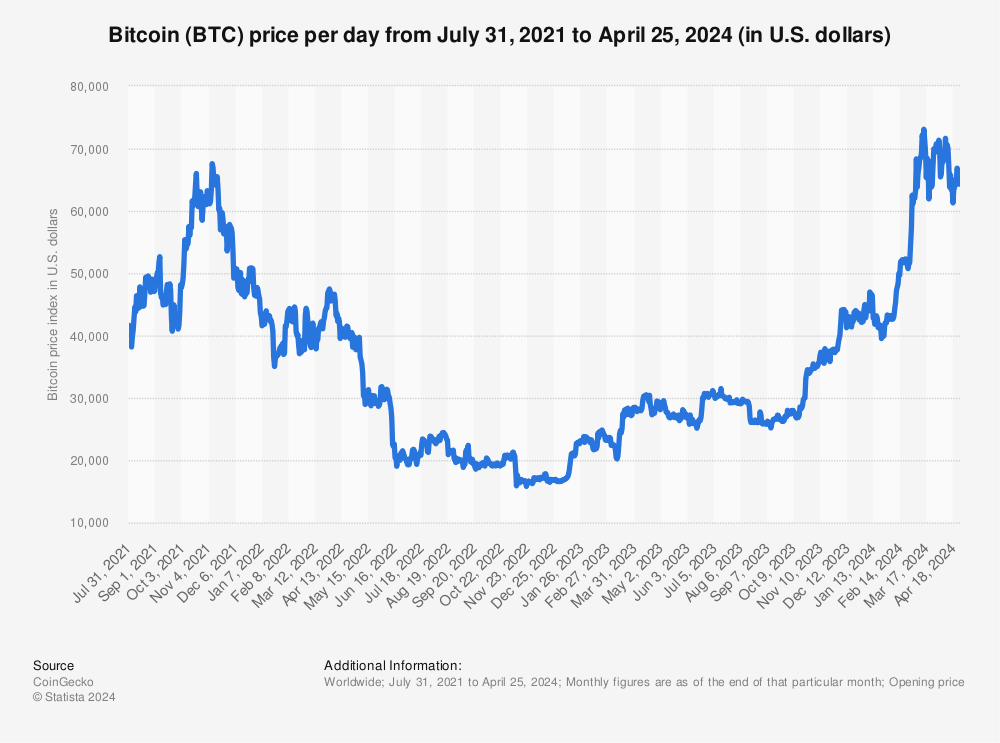

Find more statistics at Statista

What is a Crypto Reserve?

A crypto reserve is a stockpile that a government holds of digital assets, such as Bitcoin, for economic strategy. The U.S. unveiled a Strategic Bitcoin Reserve in March 2025, funded through the seizure of 213,246 BTC. It is meant to enhance the country’s standing in the digital economy.

The reserve might be used as an inflation hedge or a means of reducing debt. And then there’s the question of precisely how big its upcoming balance-sheet expansion will be, in terms of legacy holdings and also the amount of outright purchases. The 21 million coin cap of Bitcoin makes this a distinct reserve asset.

There is another very important distinction between fiat, gold, and Bitcoin—the latter lives on a distributed blockchain. It means less government oversight but more allure as a rare asset. The structure of the reserve will determine its market effects.

Its supporters consider it another step toward the mainstream adoption of crypto. Critics say the approach invites volatility and regulatory problems. Transparency on its implementation is key to the price impact.

Background: Gold Holdings

In the 1930s, the U.S. revalued gold reserves, increasing the price from $20.67 to $35 per ounce. The Great Depression was to be stabilized by the hand of the dollar. It also solidified gold’s status as an international asset.

A Bitcoin reserve, similarly, could legitimize crypto as a store of value. Government stockpiling could decrease supply and increase prices. Gold’s history points to a longer-term bullish scenario.

This stands in contrast to gold, which is physically extracted, and there can only be as much of it as there was when we picked up all the gold lying around the earth. The fixed supply of Bitcoin magnifies the effects of reserve buying. A supply shock could happen if the U.S. buys into BTC in a big way.

However, gold faced fluctuations after policy changes, including price adjustments. Bitcoin could see similar swings after the reserve announcement. Lessons from history point to both upsides and risks.

The Bitcoin Supply Shock

Market Sentiment Dynamics

Bitcoin’s price rose 11 percent in response to the March 2025 reserve announcement, to $94,164. Prices fell to $85,000 in the absence of firm purchase plans. Market sentiment carries a lot of weight in Bitcoin trading.

Institutional adoption, such as the $36 billion in Bitcoin ETF inflows anticipated in 2024, is fueling that optimism. By stopping sales of seized BTC, the selling pressure diminishes, and the price is supported. Positive sentiment may support further rallies.

Events outside the network, like the Bybit hack of February 2025, spark negative sell-offs. In February, the Crypto Fear and Greed Index collapsed to 25/100, a caution level. Price trends are very susceptible to changes in sentiment.

News about reserves receives strong reactions from retail and institutional investors. Clear policy specifics might prompt FOMO-driven buying. But uncertainty could also dampen enthusiasm and produce dips.

Regulatory Implications

The more pro-crypto policies of the Trump administration, and, indeed, a new SEC chairman, would prefer a lighter touch. The Clarity for Payment Stablecoins Act is part of an effort to simplify crypto rules. This may add to Bitcoin’s attractiveness.

Issuing reserves through new funds or other gold revaluation also has legal issues. Congress may have to authorize further BTC purchases. Market participants may be frustrated by delays in legislation.

Raghu’s remarks also indicate that if the U.S. does not go in for a CBDC, Bitcoin could be preferred as an asset. Competitive pressure is also being driven by global standards, such as the EU’s MiCA framework. Varying approaches may influence Bitcoin’s acceptance worldwide.

That would draw in institutional capital, lifting the price. Investors may be discouraged by uncertainty or prohibitive policies. Market dynamics will be heavily impacted by the path to regulation of the reserve.

Analyst Predictions for 2025

Bitwise and Standard Chartered predict Bitcoin at $200,000 before the end of 2025. They attribute it to ETF demand and to reserve optimism. Institutional adoption is still a strong upside factor.

VanEck forecasts $180,000, citing regulation clarity and halving impact. The April 2024 halving diminished mining rewards, and supply finally began to be constrained. The historical cycling through halvings is bullish for price.

Timothy Peterson forecasts a high of around $126,000 by late 2025. He ties this to the post-halving maturation cycle of Bitcoin. As a more conservative one, his estimate is adjusted to reflect intelligent reactions.

Charles Schwab’s $1 million bet would require 1 million BTC to back it up. The consensus is $126,000 to $200,000, although with 20 to 40 percent drawdowns thrown in for good measure. The predictions run the gamut from these names based on reserve performance and macro trends.

Bullish Scenario for Bitcoin

Active U.S. buying could lead to a supply shock and, ultimately, a $200,000 Bitcoin. With circulation of 19.79 million BTC, these buys are a threat on the liquidity front. Add ETF demand and global adoption to this mix.

Institutional investors would be drawn to Paul’s homeland if Trump brings pro-crypto policies. Articulate reserve plans could induce FOMO among retail traders. These are the “long trajectory” conditions in which Bitcoin becomes “digital gold.”

Fed cuts and prices’ ascent make Bitcoin an attractive hedge. There is global forward momentum with countries such as El Salvador embracing Bitcoin. Markets remain settled and continue to support the bullish trend.

The reserve’s success depends on rapid policy implementation. Massive government buys speak for big confidence in BTC. Under this scenario, momentum can be expected to continue its upswing through 2025.

Why the US Goverment Plans to Buy 1 Million Bitcoin

Bearish Scenario for Bitcoin

Failure to increase the reserve could lead to Bitcoin falling below $70,000. If Congress drags its feet on purchases, sentiment could turn negative. The price downturn could be further accelerated by profit-taking.

High Treasury yields or trade wars lead to capital flowing to safer assets. The Bybit hack in February 2025 revealed Bitcoin’s susceptibility to such shocks. Bearish dynamics could get a boost from external developments.

Strict international regulations, as in the EU, could curb adoption. Fuzzy U.S. policies fuel investor unease. The volatility of Bitcoin increases the downside risk in this case.

The lack of clarity on reserves raises the risk that the correction will be prolonged. Longer term, there may be macroeconomic headwinds shaping crypto sentiment. Broadly, policy momentum may be necessary for Bitcoin to reclaim its highs.

Conclusion

While Bitcoin’s price trajectory could be redefined if the U.S. Strategic Bitcoin Reserve legitimizes it as a strategic asset, the market mood, regulatory developments, and analyst predictions between $126,000 and $200,000 assess its potential effect. Bullish cases are predicated on massive government buying, and high bearish risks due to delays and external pressure merit careful maneuvering in 2025.