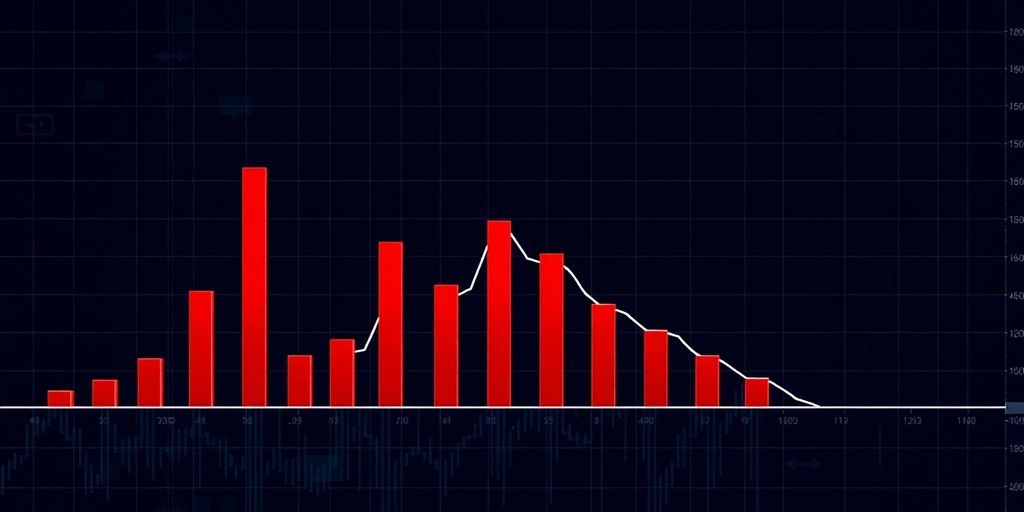

ICP Plummets 7% as Institutional Sell-Off Shatters Key Support Level

Internet Computer Protocol (ICP) experienced a significant downturn, shedding 7% of its value and breaking below a crucial support level of $5.48.

This decline, which saw the token fall to a low of $5.27, was accompanied by a sharp increase in trading volume, nearly doubling the daily average.

Analysts interpret this surge in activity as indicative of substantial institutional selling pressure.

Key Takeaways

- ICP's price dropped 7% from $5.67 to $5.27 between August 17-18.

- The critical support level at $5.48 was breached.

- Trading volume nearly doubled, signaling heavy institutional selling.

- Broader market bearishness, fueled by inflation concerns, likely contributed to ICP's decline.

Market Reaction and Analysis

The breach of the $5.48 support zone occurred during early trading on August 18, with trading volumes escalating to 708,905 units, a stark contrast to the 24-hour average of 386,248 units.

This pattern suggests a coordinated sell-off by large investors and corporate treasuries.

Initial attempts at recovery proved short-lived, as the selling pressure pushed the token back down to approximately $5.29.

Broader Market Influence

The downturn in ICP's price is occurring within a wider crypto market that is grappling with bearish sentiment.

Concerns over rising U.S. inflation, exacerbated by a hotter-than-expected Producer Price Index (PPI) reading for July 2025, have led to a general risk-off attitude among investors.

In such an environment, more speculative assets like ICP are often among the first to be sold off, further intensifying downward price pressure and reducing liquidity.

Technical Indicators

ICP's technical chart shows a clear break below a key support level, with the increased volume confirming the conviction behind the selling.

The failure of brief recovery attempts and current price consolidation near $5.29 indicate a lack of buying interest at these levels, suggesting that institutional participation has waned.

The market will be watching to see if ICP can reclaim its previous support levels or if further declines are imminent.

Sources:

- ICP Retreats From $5.75 High Amid Heavy Distribution

- Latest Internet Computer (ICP) Price Analysis

- ICP Loses Key Support as Token Falls 7% in Heavy Institutional Selling

More News: